The Grocery List: Setting an M&A Strategy

An acquisition can be the rocket fuel that accelerates the trajectory of your business or an anchor that weighs it down. How you prepare for the process can help you distinguish between one or the other.

Many companies will have acquisition opportunities land on their desk unprompted — maybe a smaller competitor is looking to join forces or you get a call from an investment banker leading a process for a business they think could be a fit.

It can be tempting to pursue these inbounds on an opportunistic basis, but before diving head-first into the due diligence of a potential acquisition, it’s critical to evaluate the opportunity in the context of your overall strategy and business strengths and opportunities.

Think of the development of an M&A strategy as a grocery list: rather than going into a grocery store hungry and walking out with a cart full of random items, a list of the things you need and the elements that would accelerate your business can help you stay focused and make smarter choices, with better outcomes.

When evaluating an M&A opportunity, your first priority should be developing an understanding of your business’s strengths, weaknesses, opportunities and priorities, all informed by the context of your ecosystem and your business’s place in it.

At Georgian, we use our Value Creation Framework as a foundation for understanding your place in the market, what makes your business differentiated and where to focus your efforts to optimize outcomes. When working with our portfolio companies, this framework provides an external ecosystem view and an internal look at gaps and opportunities across key vectors of value creation. These elements form the foundation for strategic planning and are integral to developing M&A thesis areas, or the reasons why you want to pursue a transaction. The last thing you want to do is to acquire a company that doesn’t propel you forward!

Before pursuing an acquisition, take the time to ensure two things:

1) The strategy for M&A aligns closely with the priorities and opportunities of the business.

2) M&A is the right tool to pursue the strategy rather than partnership or proprietary build approaches.

Below, we outline some “pre-process” work you can do before evaluating specific M&A opportunities, and break down the ‘why,’ ‘how,’ and ‘what’ of an effective M&A strategy.

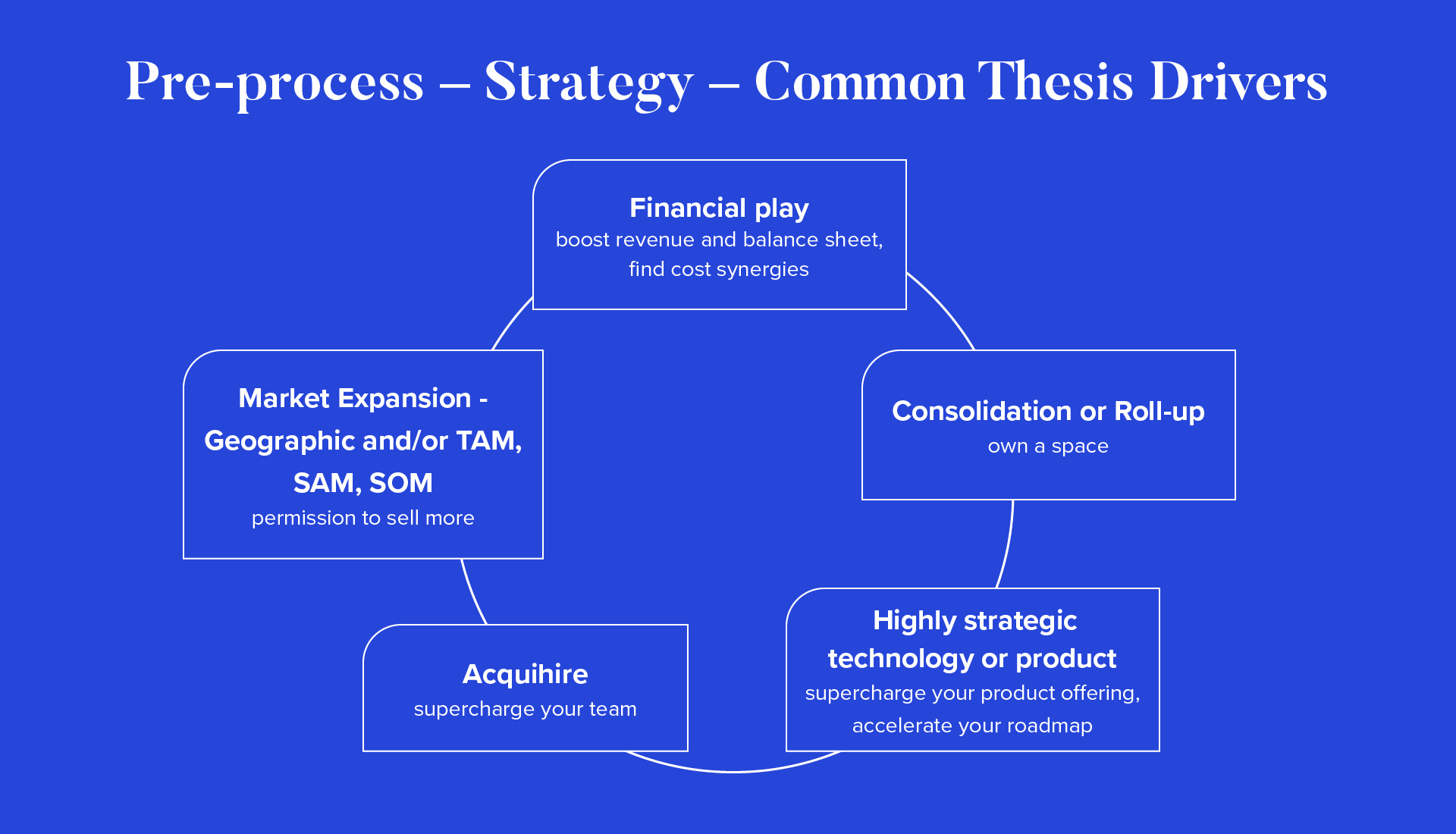

Common thesis drivers in the pre-process — the why

We’ve established that you need to have a deep understanding of your business and ecosystem. Now, it’s time to use that analysis to create strategic thesis areas that align to identified areas of opportunity — this will answer the question of why you might pursue an acquisition.

For example, the acquisition could be a product tuck-in to accelerate your roadmap or have an established geographic presence that would help you expand into a new market. You may have multiple thesis drivers that apply to a single potential transaction — such as an acquihire for key talent that would also bring in beneficial technology or intellectual property — but think about which one is your top priority to help you assess if a deal is the right fit.

The build, borrow, buy matrix

At this stage, you’ve identified why you’re considering acquisitions, but you’re still pressure testing whether M&A is the right tool to meet your business goals. Now, you need to answer the question of how you want to meet those goals.

We’ve created a matrix below where you can weigh your priorities against whether it would be most beneficial to build, borrow or buy the technology or assets that would help meet your business goals.

Imagine that your acquisition thesis is to add the next best action recommendation engine to your platform. Using the chart, together with your identified priorities, you can determine if the best approach would be to build it, partner with another company to embed the technology, or buy a company outright that has already developed the technology.

Looking at this matrix, you should know what you care most about. You need to consider the long-term implications of your chosen approach on the overall outcomes of your business. Accelerating time to market, compatibility with your existing product offering and the need to own the IP and control the product without creating third-party dependencies are often the most important factors in this assessment. Creating a third-party dependency could introduce major risk for a future exit transaction and ultimately dilute the value of the company, for example. So, if your priority is avoiding creating a third-party dependency, then borrow would not be a suitable solution. But, borrowing for a time — or trying before you buy — could be an option where you choose a partner to work with and potentially acquire.

Assuming that ‘buy’ is the right approach, the next step is to develop a list of target requirements.

Target requirements are the description of your ideal target profile. You wouldn’t send your sales team out to the field without knowing what your ideal customer profile is, and the same level of thought and discipline should be applied to your approach to evaluating M&A targets — what would the perfect target look like?

When we think about target requirements, we generally separate them into three categories: must-haves (the elements that are required for a target to be successful), nice-to-haves (the elements that are desirable but not required) and non-starters or deal-breakers (the elements that would cause you to walk away from a target if true).

While you won’t be able to confirm whether a target checks all of the boxes on your target requirements list before you engage with them, this list can serve as a diligence roadmap for the basic “what must be true” statement, enhancing the efficiency and effectiveness of the initial target evaluation process.

Keep in mind that there may be certain characteristics that are unique to a specific thesis area. Understand which ones are foundational (apply to all thesis areas) and which are specific to one or more thesis areas (but not all).

Sifting through raw data: the Georgian approach

Once you have your list of must-haves and non-starters, you can take a more disciplined approach to evaluate potential acquisitions. Think of it as a funnel of all potential targets that fit a thesis area, then qualify down based on those that satisfy as many of the target requirements as possible.

Even with a list, there is the additional challenge of sifting through prospects and raw data — based on your target requirements, you may initially find hundreds of companies that fall within your broad criteria. If you don’t have access to a private company database (like Crunchbase, Factset, 451 Research, Pitchbook, Tracxn, etc.), then you can look to resources that provide a market mapping of the space you are looking to acquire in (like an analyst report from Gartner, Forrester or G2 grid) as a starting point.

At Georgian, we leverage our unique data platform to do preliminary qualifications based on the company’s objectives. Rather than being overwhelmed by hundreds of prospects, which would be difficult and time-consuming to evaluate individually, we work with our companies to qualify the initial search down to a subset of targets that most closely match the target requirements and have the highest probability of success. We use this platform to help our companies take a comprehensive yet efficient approach to target identification and to help them make informed decisions on which targets to pursue.

We hope that our ‘grocery list’ will help you to set an M&A strategy and approach a potential opportunity with a clear framework for assessing whether it is worth pursuing. If you have questions about our process or platform, you can reach out to me at christen.daniels@georgian.io.

Read more like this

Cloud Spend Management: A Guide for Startups

Over the past several months, CoLab executives and customers have told us…

How to Use OKRs to Unlock Your Company’s Potential

You’re probably familiar with OKRs — Objectives and Key Results. OKRs are…

Team Profile: Azin Asgarian, Applied Research Scientist

What do you work on at Georgian? As part of the R&D…