Aligning Customer Success and Sales

A set of guidelines, tips, and recommendations to align your Customer Success and Sales Teams.

I have a passion for Customer Success. Both at Georgian and during my time at Bain, I have been fortunate to collaborate with many companies on their customer retention and expansion strategies. Having seen many of these projects, there is one key pattern that sticks out to me. I find that teams focus on customer success operations and sales separately, when what they need to do is improve the alignment between these two customer-facing teams.

In this post, I’ll take you through a five-step process that will align objectives, incentives and processes for sales and CS to help you identify, win and retain the right customers.

Step 1: Segment Your Customers

It may seem that getting more customers in the door should always be your number one priority. But without a clear targeting and segmentation strategy, you might end up with the wrong type of customers – customers that will slow you down and drain your team’s energy.

It doesn’t feel great to turn away business, but there are good reasons to. Here are a few characteristics of “bad fit” customers:

- They take up time: Implementation and Success teams spend loads of time ensuring that these customers are on the right track. This detracts from other customers and impacts your reputation and brand loyalty.

- They’re not good advocates: when clients are not getting full value from your product, they’re unlikely to be good references.

- They are prone to churn: it is unlikely these customers will want to continue to renew.

- They may be unprofitable in the long run: the additional resources needed and lack of expansion could end up costing your business in the longer term.

Identifying your best-fit customers

So how do you get on track to targeting the right customer segments? You’re looking for segments that are relatively easy to close, easy to retain and continue to expand their usage of your products. There are two approaches that you can take:

- Anecdotal: Gather your customer success and sales teams in a room and you’ll soon develop a good idea of how your product meets various customers’ needs, and how easy it is to acquire each type of customer. Customer Success Managers (CSMs) often offer insights into who is likely to be a good or bad fit for any given use case. Sales can provide color into how difficult it is to acquire customers from each segment. Take this approach if you want to get to a ‘good enough’ solution quickly, and if your pool of customers is relatively small. Use your intuition to place your customers into a matrix below based on what you know.

- Data-driven: by analyzing your financial data and retention patterns you can measure the lifetime value and cost of customer acquisition by customer segment. This data-driven approach allows you to go through a more rigorous customer segmentation exercise, but might take – in my experience growth stage companies require some effort to gather and analyze required data. Take this approach if you want to gain a robust understanding of each customer segments’ economics. This approach becomes increasingly important as the number of customers grows, and when there is a high diversity in your customer base (e.g. different industries, customer size, specific departments, use cases).

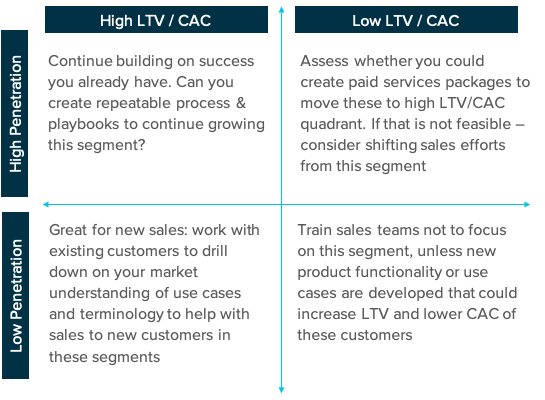

Once you have this information collected, take a look at how many customers of each type you have to determine your segment penetration. You can then plot your customer segments onto a matrix to help you visualize where your sales teams should or should not focus. In particular, you can look for green field opportunities where you have low penetration in a segment, but high LTV / CAC.

Customer segments can also move between the four quadrants of the matrix as your product evolves and as you produce more data and insights (see step two).

Step 2: Build a Feedback Loop

As you act on the findings of your segmentation exercise, you’ll soon learn more about each segment. Setting up a feedback loop between your customer success and sales teams will allow you to adjust to these new insights and continuously refine your segments.

A good way to set this up is through regular collaborative workshops between CS and Sales teams — usually monthly or quarterly. Let the teams discuss the following questions:

- Which use cases work well?

- Which industries / sectors are good to work with?

- Which geographies / regions are good to work with?

- Are some of your sales reps more suited to certain customers/segments?

- Are discounts influential?

- Service packages – do they work? Can an entry level package help?

- Partners – do they work well with certain customer types?

Asking these questions on a regular basis and profiling your customers accordingly will help you refine your go-to-market approach and focus your attention on the “good fit” customers. I would also recommend involving your Product team in these conversations, when possible.

Step 3: Define Your Model

One contentious organizational issue that SaaS leaders grapple with is the delineation of roles and responsibilities between Sales and Customer Success. How exactly should sales, account managers and customer success managers work together? Who is responsible for what? Who is the main point of contact for the customer? Who manages upsells and renewals?

Sales alignment models are informed by the stage of your company and the complexity of your product. Check out Gainsight’s work on different org structures for a deep dive on this topic.

The most common question I get is about the division of roles between CS and Sales in upsell and renewal situations. There are two main approaches here – let’s look at the pros and cons of each.

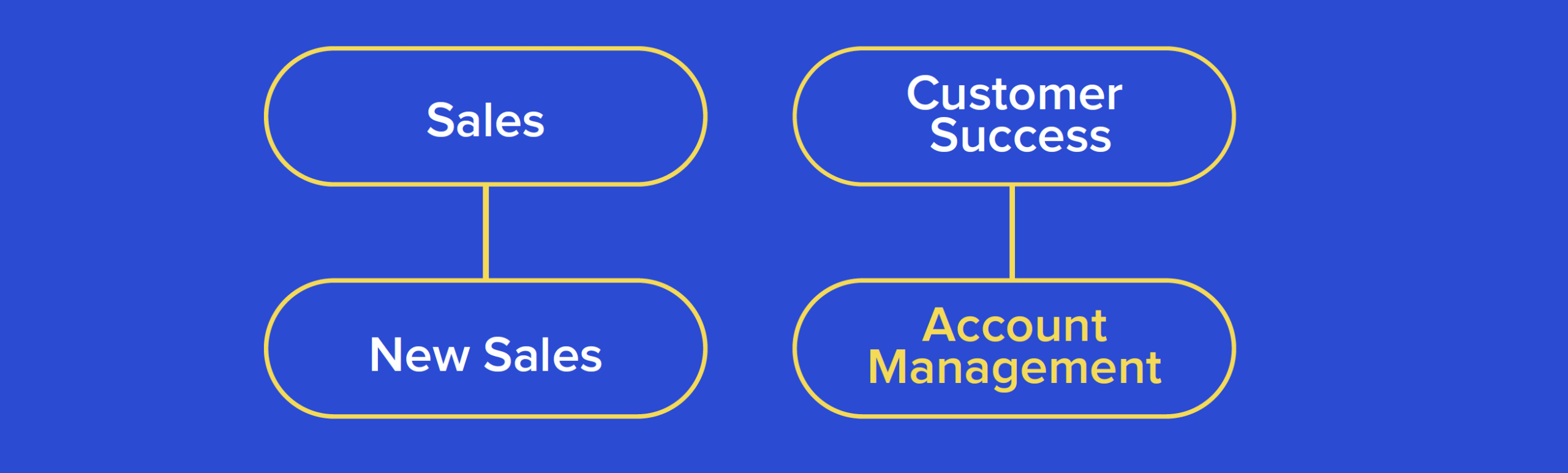

Approach One: Sales focuses purely on new sales; both upsell and customer value management is done by the Customer Success team.

Pros

- One point of contact for the customer

- CSM deeply understands the needs of the customer and can recommend the most relevant products/features

Cons

- Difficult to hire for the AM/CSM role; diverse skill set is required

- Hard for AM/CSM be a trusted advisor while pursuing sales quotas; hard to focus on sales when supporting customer

This approach works best when product complexity is relatively low, path to upsell is pretty straightforward, and the renewal process is simple.

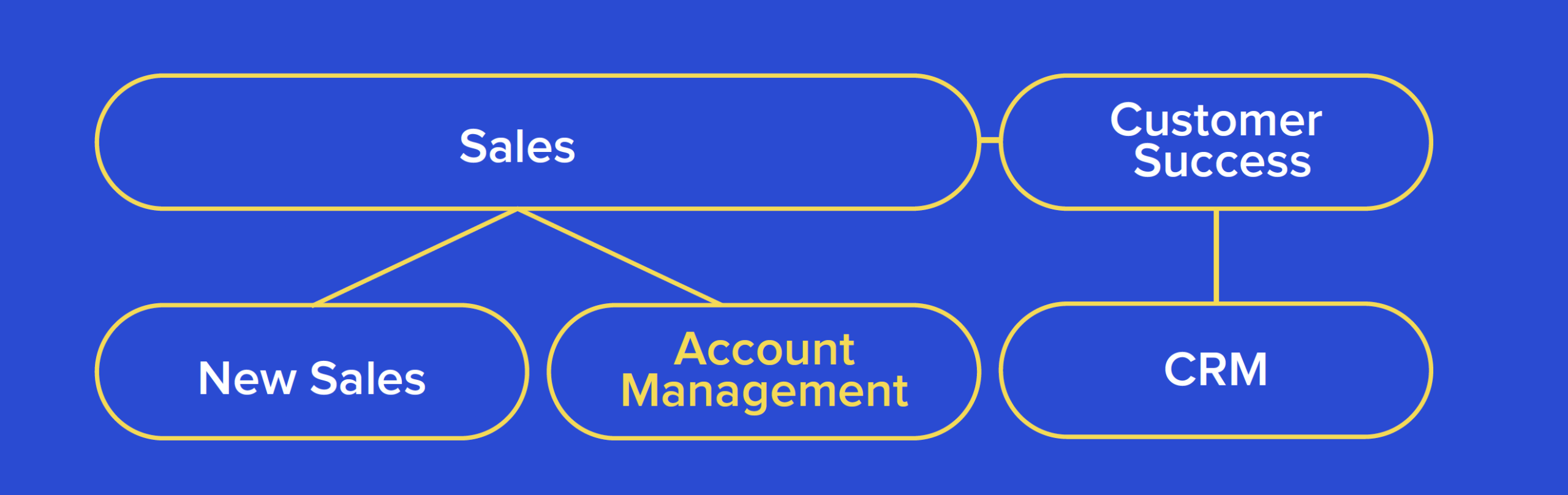

Approach Two: new sales and upsell managed by Sales, customer value management done by Customer Success:

Pros

- CSMs focus on keeping customers happy – perceived as ‘trusted advisors’ and not as ‘pushy salespeople’

- Sales reps do what they do best – sell

Cons

- Several points of contact for the client creates confusion

- May create conflict of interest between sales reps and CSMs

This approach works best where product complexity is relatively high, when upsell is usually targeted towards new business users or new departments, and the renewal process is competitive and akin to resale.

Another approach is to allow Customer Success to handle simple upsell and expansion opportunities and straightforward renewals, and engage Sales for more complex scenarios.

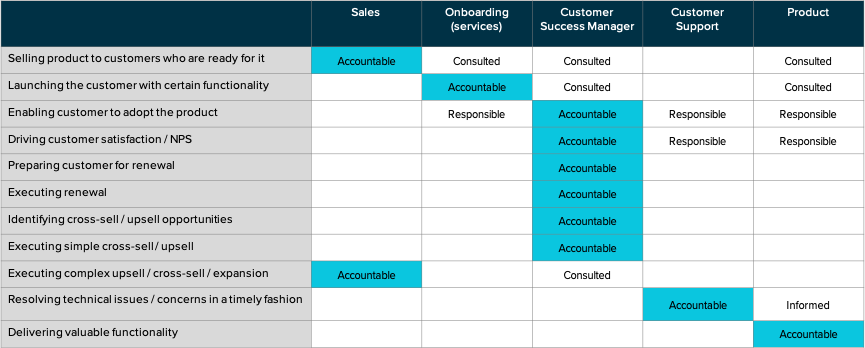

To avoid confusion about respective roles and get everyone across both teams on the same page, I find it helpful to create a RACI map (Responsible, Accountable, Consulted, Informed). A RACI map shows responsibilities and assignments for every task, milestone, or key decision involved in completing a project.

Check out the example below to see how this works. These maps are pretty self-explanatory—the main rule to remember is that there can only be one person or role marked as Accountable for each task, yet there might be multiple people Responsible for the activity (people actually doing the work).

Step 4: Incentivizing desired behaviour

However you set up your team structure, keep in mind that compensation and incentives need to be aligned to motivate the right behavior.

Start by defining your business objectives – you can use the ideas in the three categories below to get started:

| Key Objectives | Secondary Objectives | Other Objectives |

| New recurring revenue | Capturing specific logos | Signing customers in your high ACV / low penetration quadrant |

| Cash upfront | Maximize number of new logos | Expanding quickly to beat out the competition on green field opportunities |

| Longer term contracts | Sell strategic or new products, or specific product mix | References |

| Signing good-fit customers from preferred segments | Keep high gross margins | Maintaining pipeline predictability |

| Maximum renewal rate | ||

| Expansion / upsell |

How to Design Sales Compensation to Drive Good Sales Behavior

Compensation structure should be simple, where possible. For a good overview of comp design, read this article which provides the commission rates I’ve used below. Typically, this is split into three key areas:

- New Sales

Typical commission rates: 10-15 % of first year ACV

This is usually the largest part of sales compensation. However, if reps are only compensated on new sales, they may not care about renewals and lifetime value. They may also sell into non-optimal segments, or they might be motivated to oversell by making the initial scope of the sale too big, which can lead to difficulties with delivery, future downsell or even churn. To avoid these challenges, you might want to consider negative clauses such as clawbacks on customer churn, or positive incentives for future contract expansions.

- Expansion, Upsell, Cross-sell

Typical commission rates: 8-9 % of ACV

This commands a lower commission rate as it is usually easier to upsell to existing customers.

- Renewal

Typical commission rates: 1-5 % of ACV

According to KeyBank capital markets SaaS survey, around 50% of SaaS companies offer a small percentage of commission on renewal sales.

Other incentives to help promote positive sales behavior include:

- Spiffs: Offered for focused achievements such as length of contract, cash-up front, capturing specific logos etc. Can be additional 1-2% of ACV.

- Non-cash rewards: Promotion, vouchers, team outings, “President Club” vacations, etc.

A good exercise for you to go through at this stage is to list your key objectives and decide whether your compensation structure fits with your key business objectives. Decide how often you should revisit and evolve your compensation structure as your business grows.

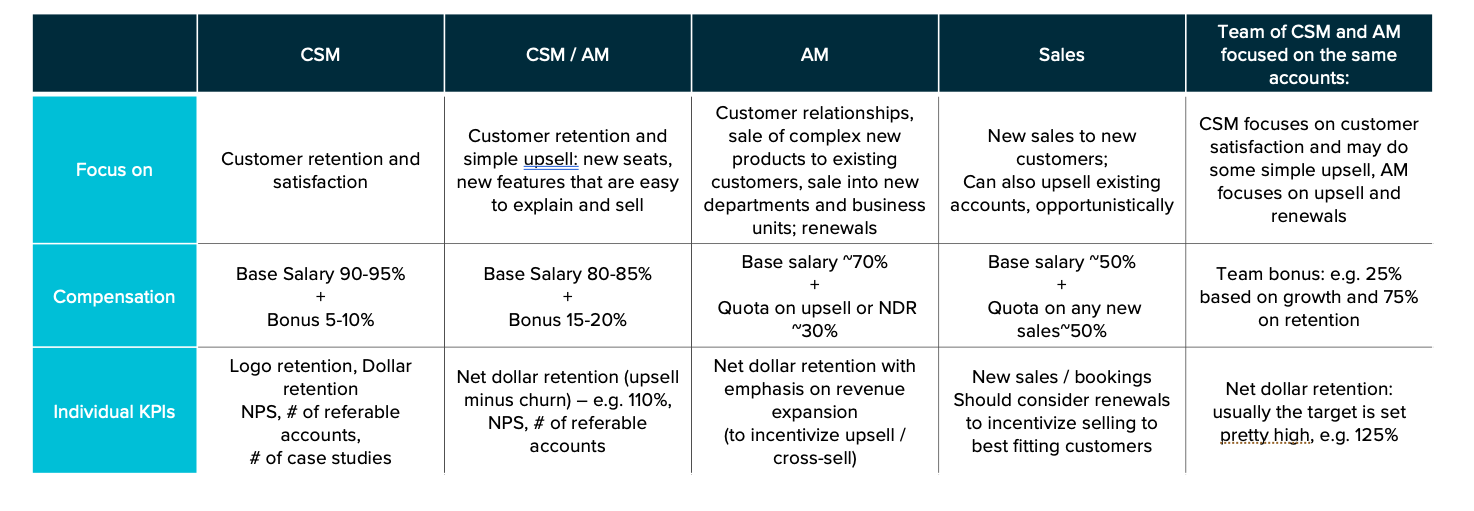

When you consider compensation structure based on the role, refer to the table below for guidance on how to structure incentives depending on the scope of responsibilities. Customer Success Managers whose role is to manage customer value should not be distracted by quotas and commissions. Just give them a nice 10% bonus for hitting their KPIs such as high NPS or number of referenceable accounts.

In contrast, sales-oriented roles should have commission-based compensation. The harder the sale, the bigger the variable part of the compensation: your ‘hunters’ should get ~50% of their compensation as a commission, while ‘farmers’ (account managers or customer success managers that have upsell targets) should get slightly lower variable compensation in the range 15-30% – again, the harder the upsell, the higher the variable component.

Another good approach is to create a team of CSM and AM focusing on the same group of customers, with a set of joint KPIs for the two of them. In this case the CSM will focus on making sure customers are using the product and getting the expected value, while the AM can focus on upsell, explaining new product functionality to the customer and building new relationships within customer organization. This way AMs will not get distracted by solving customer’s problems, while CSMs won’t have to worry about hitting quotas, and can fully dedicate the time to helping their customers succeed with the product. A common KPI for this type of team is Net Dollar Retention. This metric will allow the team to offset unfortunate churn by expansion of healthy accounts.

Step 5: motivate Sales and Success teams to help each other at every step along customer journey

The final step is to understand how to best optimize your customer journey by establishing a framework for cross-team collaboration. The best teams I have seen focus on mutual support of sales and customer success teams at every stage of the customer journey.

Acquiring the right customers and setting expectations: Early in the sales cycle, CSMs can help frame up an opportunity. As experts on product implementation, CSMs are key for expectation setting. They can help the sales rep scope the implementation and ensure that the right steps and timeframes are being established to deliver customer value. Build out a 30-60-90 day plan to make sure you are executing on delivering value quickly.

Handover from CS to Sales: The handover from Sales to CS is another crucial collaboration point. One way to ensure a smooth transition is to focus on customer goals and map those to product use cases. Identify the most pressing objectives to help prioritize those in onboarding. I would strongly encourage Sales and CS to create a Success Plan to capture target KPIs, expected ROIs, and desired timelines for each customer. This plan should become the main working document for CSMs past the onboarding phase.

Onboard new customers: This is often when sales teams tend to stand back to allow CS to do their work. However, by maintaining sales insight into the onboarding process, you can help improve the scope of future sales by watching new customers as they see value for the first time. Sales can also see first-hand any gaps between customer expectations and reality.

Expand Customers: Depending on the roles and responsibilities you set as per the previous steps, expansion may be a joint effort between Sales and CS. By maintaining regular sync ups between the two teams, it should be possible to actively identify opportunities for upsell.

Ensure Renewals: Finally, renewals can be complex – is it a renewal or is it a resale? Has the value prop changed since the last renewal? Is the customer realizing ROI? Sales can help CS team with renewals, especially with large strategic accounts. CS can help Sales identify new use cases and expansion opportunities to turn renewals into upsell.

There are many more ways to effectively align these two teams depending on the specifics of your organization. I often see companies benefit from running a workshop to brainstorm on three key questions for each stage in your customer journey:

- What can Sales reps do to help CSMs?

- What can CSMs do to help Sales reps?

- What can leadership do to ensure alignment between these two teams?

Finally, review the workshop answers and prioritize them.

Conclusion

I hope this gives some useful insights into how Sales and CS can work together effectively to not only improve your acquisition and retention metrics but more importantly to provide a better experience for your customers.

If you have any questions about the strategies I have suggested here, I’d be happy to discuss them. Please feel free to connect with me!

Read more like this

Cloud Spend Management: A Guide for Startups

Over the past several months, CoLab executives and customers have told us…

How to Use OKRs to Unlock Your Company’s Potential

You’re probably familiar with OKRs — Objectives and Key Results. OKRs are…

Team Profile: Azin Asgarian, Applied Research Scientist

What do you work on at Georgian? As part of the R&D…