G7: The Seven SaaS Metrics Georgian Uses to Evaluate Growth-stage Software Companies

Originally published: April 30, 2021

Updated: Sept 25, 2023

At Georgian, we invest in high-growth software companies and help our customers find solutions to their technical and business challenges so they can grow with confidence. We also build our own software with the goal of helping our companies scale. We’re passionate about both the data and the metrics we use to explain our view of financial success to current and future partners.

In 2019, we undertook an exercise to simplify and strengthen the benchmarks we use to evaluate the health of growth-stage software and technology companies. We analyzed data from 100+ technology IPOs and private benchmarks during this process, including OpenView, KeyBanc Capital Markets (“KBCM”) and Scale Venture Partners. Collectively, these sources cover over 2,000 growth stage software companies. We then back-tested that data against our customers the 50+ companies in our portfolio at the time, to determine the “top” metrics that helped define our own view of our companies’ success.

Introducing the G7 Metrics

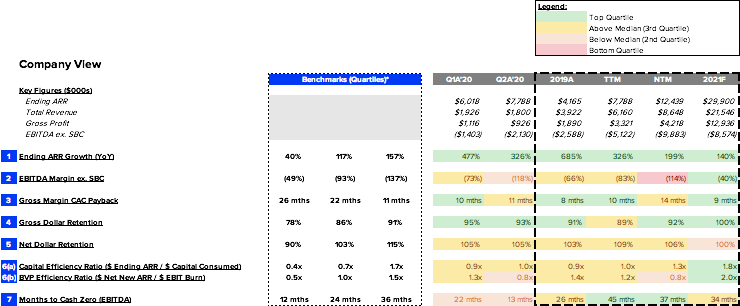

Coming out of this work, we created a new framework composed of the seven key metrics that we use to evaluate the strength of a growing technology company. We call it the “Georgian 7” or “G7” for short.

So what are those metrics?

The G7 Metrics

- ARR Growth YoY (ARR = “Annual Recurring Revenue” Year Over Year)

- EBITDA Margin excluding SBC (SBC = “Stock-Based Compensation”)

- Gross Dollar Retention

- Net Dollar Retention

- Capital Efficiency

- Gross Margin CAC Payback (CAC = “Customer Acquisition Cost”)

- Months to Cash Flow Zero

In our view, no single one of these metrics will tell the whole picture, so we tend to look at the seven in combination.

As growth-stage investors, we look for companies in the “top quartile” in at least four of the seven metrics. Our analysis shows that this level of performance is intended to provide a signal of future success of a company. We also look for consistency—both annually and quarterly—to indicate that the company should be able scale predictably.

The result of a G7 analysis looks something like the chart below. If you’d like to calculate your version of the G7, you can download “simple” version of the tool here.

At a high level, the characteristics of a leading technology company are the same for digital disruptors and technology-enabled services, AI companies and pure-play SaaS. These companies are:

- Growing quickly

- Managing the company’s cash flow prudently

- Retaining and growing existing customer relationships, and

- Efficiently generating revenue for every dollar invested in the business (and specifically into sales and marketing).

The G7 is intended to capture these qualities. Since no one metric dominates the evaluation, a review of these numbers provides an assessment of how attractive a company’s financial metrics are, compared to a broad set of public and private companies.

In addition, we track several other SaaS metrics, including lifetime value/ customer acquisition cost (LTV/CAC) and renewal rates. At Georgian, we track another 40+ SaaS metrics when evaluating a new investment. Still, we refine our view to these seven to summarize leading indicators of potential future health and success of a business.

Benchmarks that Vary with Scale and Customer Type

While the approach is conceptually simple, it is not a “one size fits all.” There are important nuances for the size of both the company and the contracts the company is selling.

Common benchmarks for ARR or Revenue, for example, vary dramatically depending on the size of a company, with a $10M ARR company expected to grow at least twice as fast as a $100M ARR company. Scale Venture Partners described this dynamic well when introducing the Mendoza line in 2018 (video explanation here). The Mendoza line represents Scale’s view of the minimum growth required to remain on an IPO trajectory and attract strong venture capital interest at various company sizes (measured in Revenue). EBITDA Margin follows a similar pattern, with most companies burning a significantly higher percentage of Revenue in the earlier years than in later years.

Similarly, companies that sell what would be considered small and medium-sized businesses (“SMB”) deals can’t be held to the same Gross and Net Dollar Retention standards as those targeting the enterprise deals; a company selling $10,000 SaaS deals, for example, generally doesn’t have the same retention as a company selling $1 million deals with $200,000 in implementation fees (common in the enterprise). Tomas Tunguz covered this segmentation of SMB, mid-market and enterprise churn expectations in 2015 in his popular blog – you can see his general observations about customer account churn rates by segment.

| Segment | Monthly Customer Churn % | Annual Customer Churn % |

|---|---|---|

| SMB | 3-7% | 31%-58% |

| Mid-Market | 1-2% | 11%-22% |

| Enterprise | 0.5-1% | 6%-10% |

Static Benchmarks

While company age and deal size matter for certain SaaS metrics, we’ve found that others don’t fluctuate much with scale or deal size. These metrics, which we refer to as static, include Customer Acquisition Costs (CAC) payback, Capital Efficiency and Months to Cash Flow Zero. While there are some variances by both size and scale with these static metrics, our research shows that variance is not typically consistent or significant enough to be factored into the approach.

Calculating the G7 Metrics

The table below summarizes the G7 metrics and their respective calculations.

| Benchmark | Type of Benchmark | Purpose of the Calculation | Calculation |

| 1) ARR Growth % YoY | Changes with company size | Top line growth; measures overall momentum | Last quarter ARR growth YoY. Can also be measured in CARR** |

| 2) EBITDA Margin % | Changes with company size | % of Revenue re-invested in growth | TTM and current quarter EBITDA Margin ex. Stock-based Compensation (“SBC”) |

| 3) Gross Dollar Retention | Changes with deal size (ACV) | $ of ARR lost every period – the “leaky bucket” | (Starting ARR – Churned ARR – Contraction ARR) / Starting ARR |

| 4) Net Dollar Retention | Changes with deal size (ACV) | % at which the existing customer base grows or shrinks each year | (Starting ARR + Expansion ARR – Churned ARR – Contraction ARR) / Starting ARR |

| 5) Gross Margin CAC Payback | Static | Months required to repay sales & marketing | Fully Loaded S&M / (New + Expansion ARR) x SaaS Contribution Margin x 12 |

| 6) Capital Efficiency Ratio | Static | ARR generated for every dollar of debt or equity invested in the business | $ Ending ARR / Capital Consumed (“CC”), where CC = (Equity Raised + Debt Drawn – Cash on B/S) |

| 7) No. of Months to Cash Zero | Static | Number of months of cash runway, post financing if currently raising | Post-money balance sheet/average monthly burn (higher or current or forecasted) |

* Note: If your company is not SaaS software, we recommend subbing “Annualized Gross Revenue” wherever you see ARR.

** CARR which stands for contracted (or committed) annual recurring revenue takes into account known future business and known future cancellations that don’t yet show up in ARR

A Word on Capital Efficiency Ratio and Number of Months to Cash Zero

Metrics one through five are widely understood, as most technology companies (and investors) focus on them. The two metrics that often require more explanation are: the Capital Efficiency Ratio and Number of Months to Cash Zero and I’ve added some additional detail below on them.

Capital Efficiency

Capital efficiency measures how well the management team uses money raised from outside investors (either debt or equity) to generate revenue. It measures efficiency since the company’s founding, tracking every dollar raised and every dollar spent versus current revenue. It can be calculated as:

$ Ending ARR / Capital Consumed (“CC”), where CC = (Equity Raised + Debt Drawn – Cash on B/S)

The “sister” metric to Capital Efficiency (we sometimes refer to it as metric 6b in the G7 framework) is the Efficiency Ratio (or Score). The Efficiency Ratio, popularized by Bessemer in their State of the Cloud report in 2019, measures Net ARR added over a defined period (often the last year or quarter) compared to burn.

You calculate it as:

Net ARR Added / EBITDA Burn excluding SBC, where Net ARR = New ARR + Upsell ARR- Churned ARR – Downsell ARR

These two metrics, assessed side-by-side, show whether a company’s overall ability to turn external investment into revenue is improving or declining over time. Just as some of the earlier metrics are dependent on company size and scale, this metric is also nuanced. For example, AI companies or companies with a hardware/software mix (e.g. VR or autonomous vehicles) may have lower Capital Efficiency early on. That’s because these companies generally need to invest significantly in R&D early to build their algorithms and hardware. Once their monetization strategy takes hold, however, the Efficiency Ratio can typically improve and the company’s Capital Efficiency as a whole levels out well before an IPO or at-scale exit.

Number of Months to Cash Flow Zero

The Number of Months to Cash Flow Zero is an under-valued SaaS metric that, as the name implies, measures the number of months until a company is out of cash.

Cash on the post-money balance sheet/average monthly cash burn

The length of this time period is usually relevant to both investors and operators. We view this metric as a meaningful measure of “risk” for venture capital. It shows how long a management team and board has to realize their plans such that another investor will finance the business (assuming the company cannot get to cash flow breakeven), management will need to sell the company, or simply foreclose.

As a general matter, having only 12 months to execute on a business plan after raising capital before needing more capital is riskier than having 36 months of cash in the bank. Bessemer recommends a minimum of 24 months in its 2019 State of the Cloud Report, and our customer data suggests a median of 24 months and top quartile of 36 months (post-Series B).

Conclusion

We view the G7 as a simple but effective framework for analyzing a company’s financial performance. We have used it to evaluate companies no matter the size of the company, the size of the deal or the business model.

The benchmarks we reference can be found here, in addition to a simplified version of our template.

Read more like this

Cloud Spend Management: A Guide for Startups

Over the past several months, CoLab executives and customers have told us…

How to Use OKRs to Unlock Your Company’s Potential

You’re probably familiar with OKRs — Objectives and Key Results. OKRs are…

Team Profile: Azin Asgarian, Applied Research Scientist

What do you work on at Georgian? As part of the R&D…