How to Tell Your Story to Growth-Stage Investors

So you’re an early-stage startup that’s seeing more customers and more excitement around your product, and now, you’re ready to fundraise to hit that rocketship growth. But the same pitch and pitch deck you used to raise your early rounds is completely different from your growth round — there are new metrics and new expectations to account for with growth-stage investors.

At earlier stages, you’re more focused on selling the potential of your business, the strength of your team and how large your market is; investors listening to your pitch are focused on the big vision. But once you hit that series B or C stage, investors are focused on more quantitative metrics, so it’s time to demonstrate traction.

At Georgian, there are many considerations we’re making when evaluating companies. We drafted this guide to help you better understand the most important metrics you should use to tell your story, and why storytelling is so important in a pitch. This article is part of a series we’ll be doing over the next few months on the fundraising process.

As companies look to expand their runway in light of more challenging financing markets, we wanted to provide founders with some tried-and-true methods to maximize their chance of successful growth-stage fundraising.

We’re looking for efficient and predictable businesses

At the growth stage, we’re not making bets — we want to see a strong business, and we want to make sure every company in our portfolio has a high chance of making it. If a Series A pitch deck is longer and has 3x more statistics than a seed deck, then a Series B deck will have an incremental amount of financial and metrics-oriented slides. Note that this doesn’t mean your pitch deck is necessarily longer — we’ll get to that later in this piece.

There are two questions that are top of mind as companies pitch:

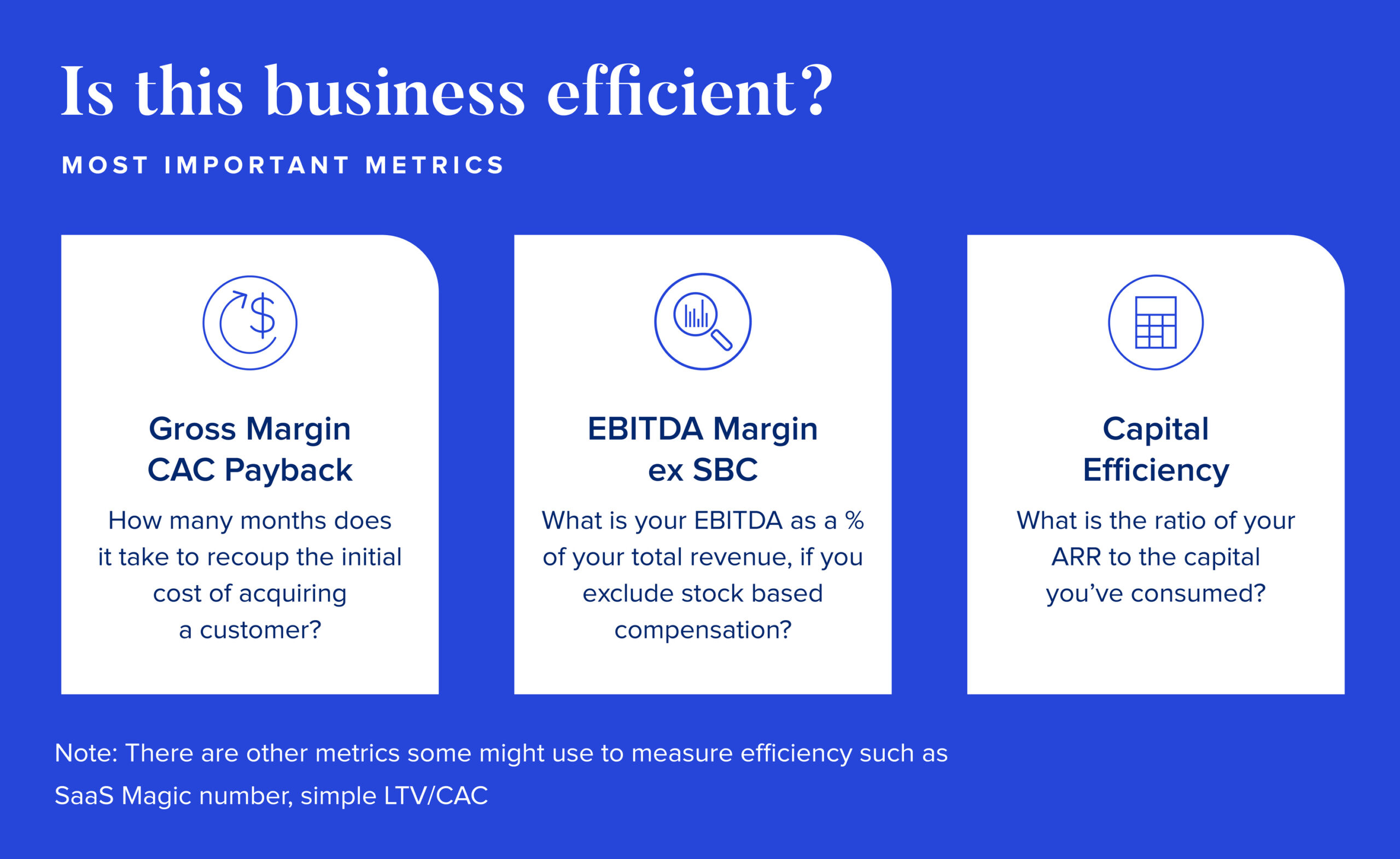

- Is this business efficient?

We expect that you’ve generated a lot of data and metrics related to your company, and we want to see whether you have a playbook for making your business efficient.

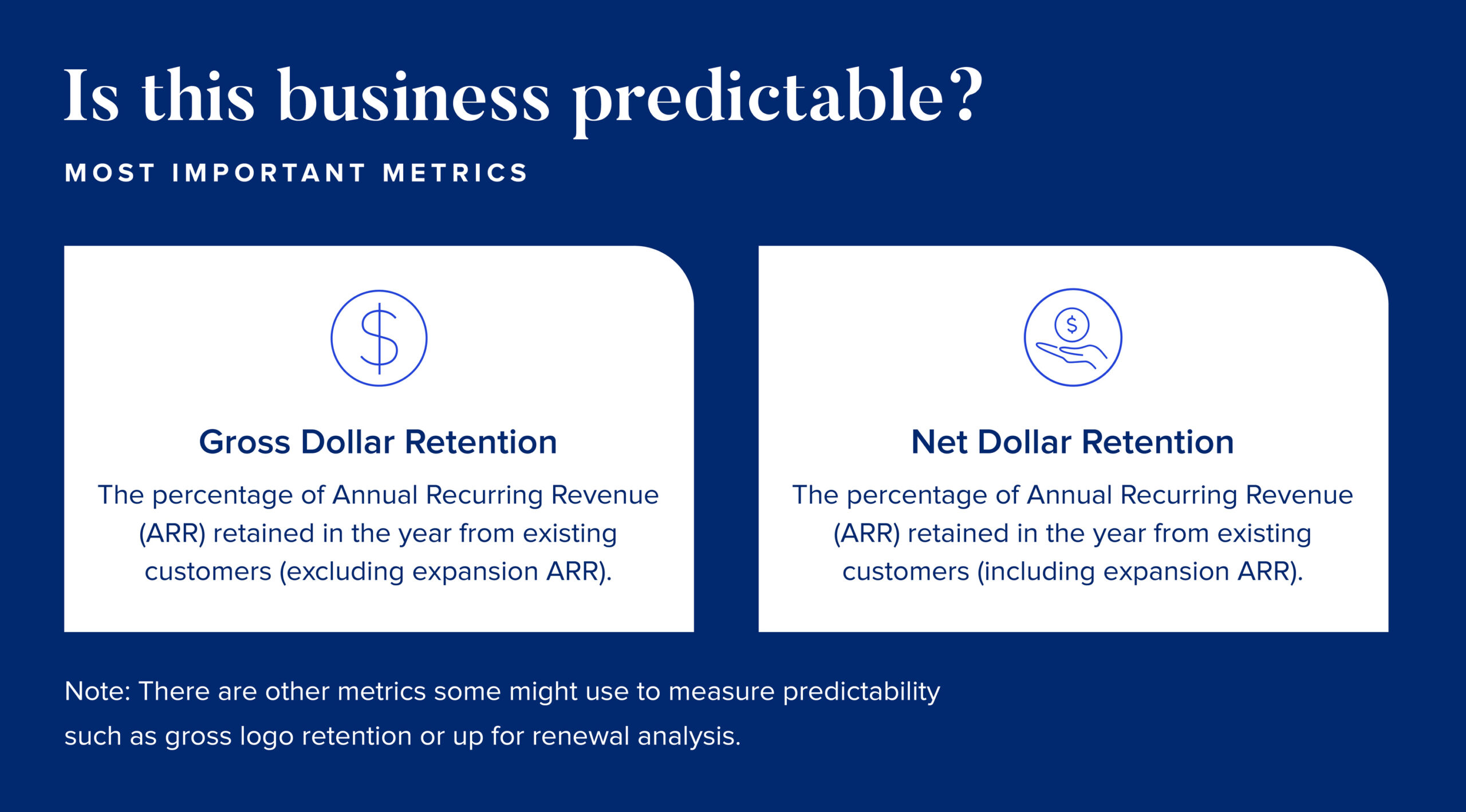

- Is this business predictable?

You should have a defensible moat and the metrics to show that there’s predictability in your financial metrics.

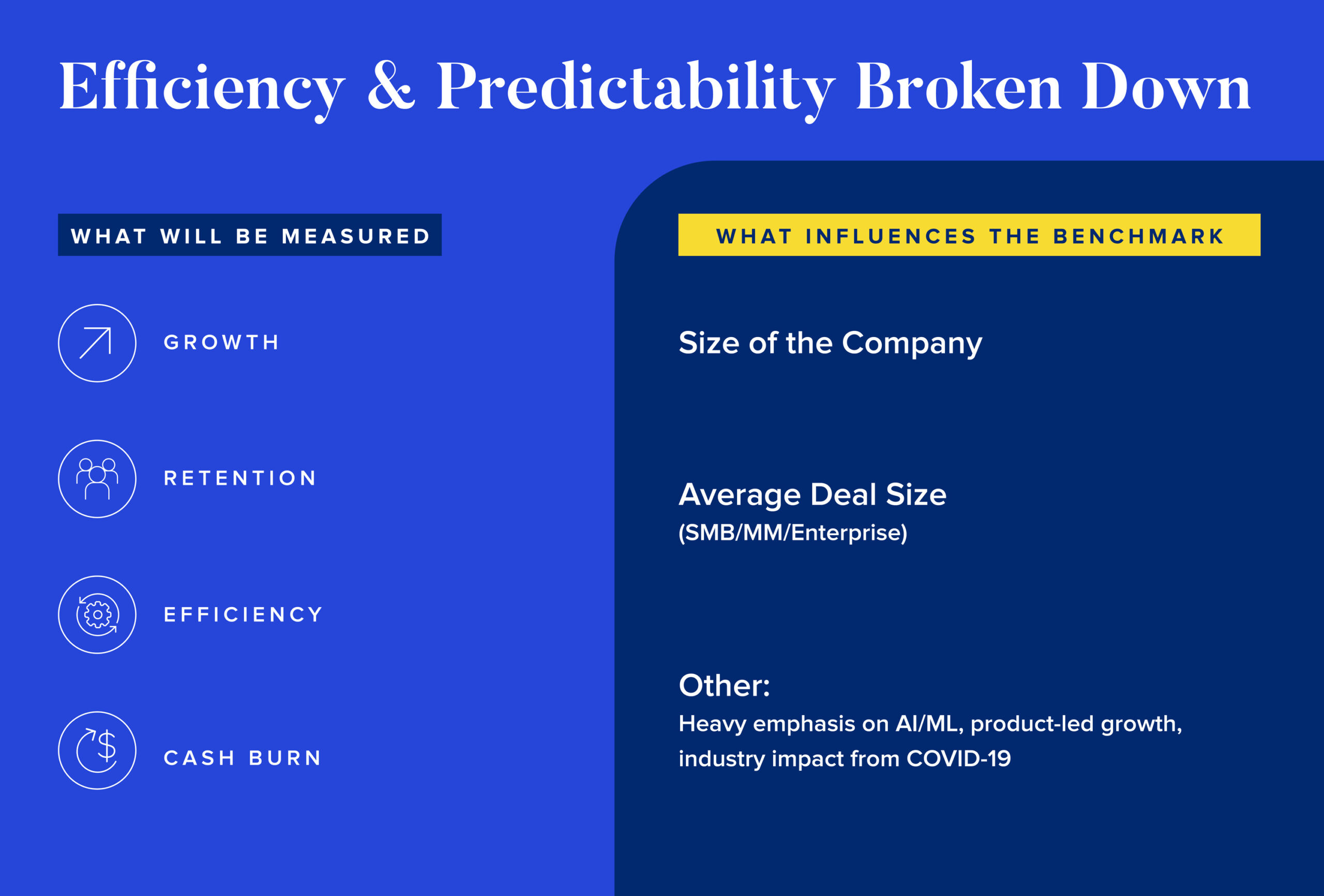

If you’re feeling overwhelmed by all the metrics that show efficiency and predictability to investors, these can be broken down into four main categories.

Four Categories of Efficiency & Predictability

There are certain indicators that influence the four categories of growth, retention, efficiency and cash burn.

The size of the company and target customer that entrepreneurs are selling to are two important factors in these metrics. For example, if entrepreneurs have consistent multi-million dollar enterprise deals, investors would expect a high retention rate. On the contrary, if a company targets the SMB as their customer, investors would expect a lower overall retention rate.

The size of the company and who entrepreneurs are selling to are two important indicators of growth; for example, if entrepreneurs have consistent enterprise deals, those can be worth multi-millions. In turn, this can end up influencing retention. A lot of these metrics have snowball effects on each other.

Overall, here is how we measure these qualities:

If you want to go deeper on how you’ll be measured, we wrote this guide on Georgian’s G7 SaaS metrics that we use to evaluate growth-stage companies. The G7 outlines the seven most important metrics that we look at.

Other VCs, like Bessemer or Openview, also have their own guides for what they measure, but the fundamentals are almost always the same. The good news is that many VCs are more transparent about how they measure these categories of efficiency and predictability.

Don’t be “afraid to cheat on the test” by asking VCs which metrics will be the most highly scrutinized. By understanding where your company fits in these categories, you can better focus your story on your financial predictability and how they tie into the core components VCs care about.

How to Structure Your Pitch Deck

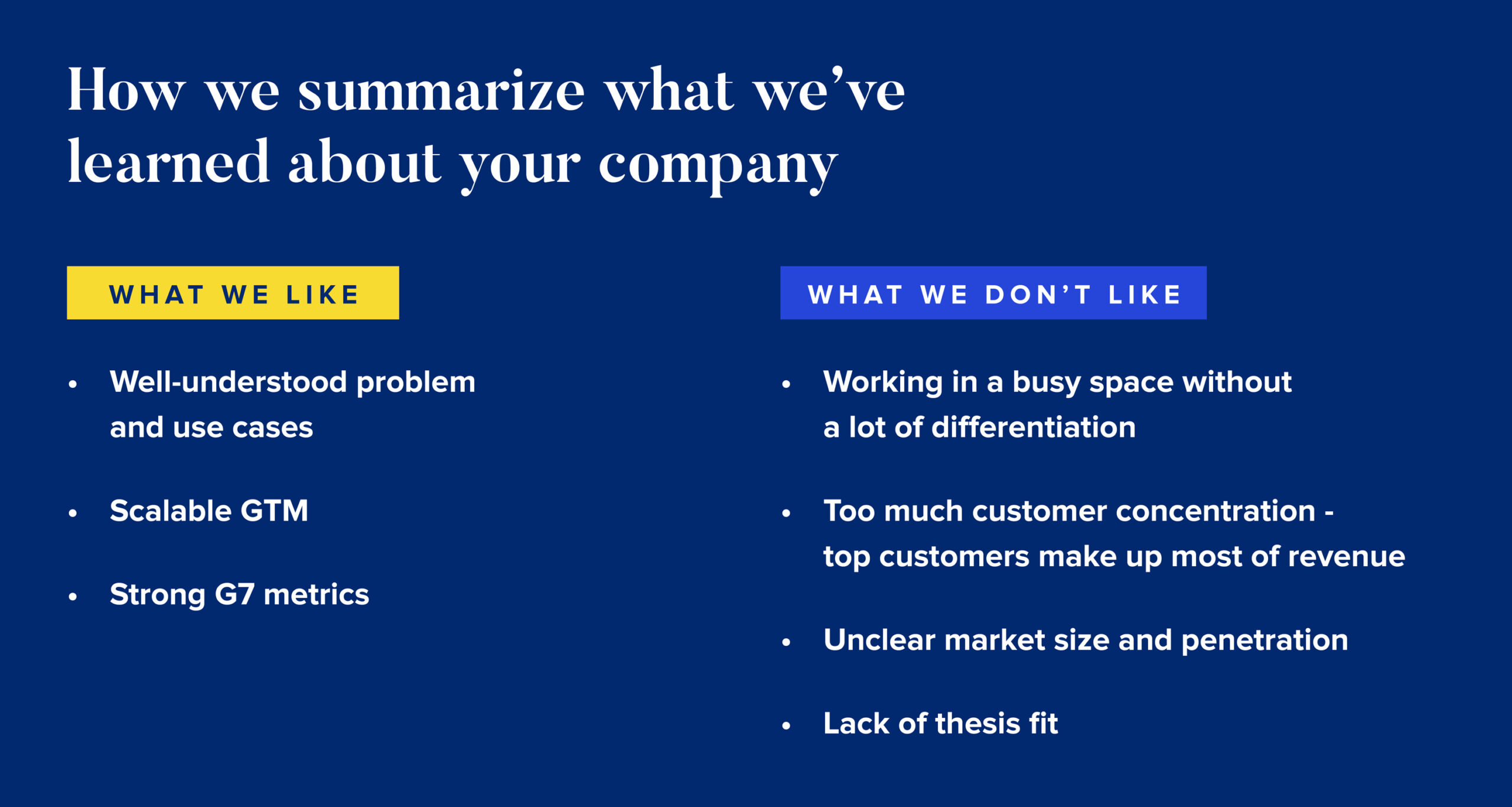

VCs summarize what they’ve learned about you from your pitch in order to make the case to their colleagues. At Georgian, we will often make a slide deck with the below outline that details some high-level decisions about what we love about your market, product and traction. We also include any questions or concerns about your potential to scale.

Here’s a template including examples of what we would put in each category, depending on the company’s characteristics and traction:

As you can see, to help your point-of-contact VC be a champion for your company in a compelling way, you can structure your pitch deck to directly answer these questions and stand out.

Here Are Some Tips on Structure:

- Use punchy titles to make it easier for VCs to communicate your value proposition to their peers.

- Explain why you’re better than the competition with proof, such as win rates. You can also use your competitors to explain your competitive advantage; this will show both your value proposition and knowledge of your industry.

- Include a data room that is easy to reference so investors can answer questions from their colleagues.

- Some good advice from Steph Korey, former CEO of Away, in Business Insider: Don’t worry if you don’t have enough data to show anticipated traction; focus on other metrics you can share, like qualitative feedback from initial research.

- Include a selling summary that outlines how your business operates:

- Who are your customers?

- Are you taking out incumbents, or is your industry a “green field” ripe for disruption?

- What is your market size? Don’t have investors question this by being too broad.

According to Hristo Odiseev, CIO of Berlsmann’s RTV Media Group, the average time an investor spends on your deck is under four minutes. So, it’s important you make the time count.

Here are some examples of pitch templates you can follow:

- The Sequoia Capital pitch deck template includes 10 slides, each with one key point

- Guy Kawasaki advises a 10/30/30 rule for pitch decks: A pitch should have 10 slides, last no more than 20 minutes, and contain no font smaller than 30 points. Note that this doesn’t mean that you should be less transparent about important metrics!

- Maybe you don’t want to go the route of a pitch deck. In 2019, Rippling raised a $45M Series A with a memo, saying it was a strong medium for storytelling rather than just focusing on visuals. They outline how they did that here, including an example of the memo.

- You can also get creative about the tools you use. Argyle, for example, used Notion to create a “choose your own adventure” style pitch, and created unique data rooms for each investor. They raised $20 million with this approach.

Some Old-Fashioned VC Psychology

Based on what we’ve discussed so far, you can see that pitching isn’t just about hard metrics — it’s about getting investors to perceive you in the way you want and get them to listen to you.

It’s important to have a positive and professional working relationship to get investors on your side. If possible, warm intros to funds that are the right fit, for the right person, can set a positive tone for the relationship.

Something to keep in mind is that investors are actually quite forgiving; they’ll just keep asking questions if needed. The reality is, if your company is compelling, we’ll keep looking.

Acknowledge the Risks

Especially in the current environment, you’ll want to address risk factors with your investors. As COVID-19 shut the world down in 2020, Sketchdeck, which wrote a blog sharing what they learned from designing 200 pitch decks, noted that founders should know how to plan for events like the pandemic as investors will ask.

The same can apply during the current downturn. As companies and their customers face tough times, note the ways that you can weather the storm, such as your experts on staff and how you’ll handle customers cutting costs.

Some Final Notes

If it’s easy for an investor to explain how big a company’s market is, the high-level metrics that matter, how fast they’re growing and their secret sauce, it increases the chances of getting buy-in from the whole investing team.

Always think about both sides of the table. Investors make for more empathetic partners if they have been entrepreneurs. Entrepreneurs make better pitchers if they think like an investor.

In our next article, we’ll go into more detail about what to expect in the diligence process.

Read more like this

Cloud Spend Management: A Guide for Startups

Over the past several months, CoLab executives and customers have told us…

How to Use OKRs to Unlock Your Company’s Potential

You’re probably familiar with OKRs — Objectives and Key Results. OKRs are…

Team Profile: Azin Asgarian, Applied Research Scientist

What do you work on at Georgian? As part of the R&D…